Calgary is emerging as a prime Canadian real estate hotspot thanks to its affordability, steady growth, and thriving job market. Beyond its energy roots, the city’s diversified economy and expanding population support reliable rental demand and long-term value. Discover why Calgary could be the perfect addition to your investment portfolio.

Key Takeaways

- Calgary’s economy is strong and diversified, reducing exposure to energy sector risks.

- Real estate remains relatively affordable compared to Toronto or Vancouver, with steady growth potential.

- Demand from a growing population and job market supports reliable rental yields and low vacancy rates.

- A variety of property types and neighborhoods cater to diverse investment strategies and long-term goals.

Calgary’s Economic Landscape

Calgary’s economy is no longer defined solely by the energy sector. Today, the city benefits from a diversified landscape that includes technology, financial services, logistics, and professional services. Lower corporate tax rates encourage business growth, and a thriving job market attracts both talent and investors. As the population continues to climb, this dynamic economic backdrop fuels sustained demand for housing, strengthening the city’s real estate market fundamentals.

Investing in Condos

Calgary’s condo market appeals to investors seeking relatively low-maintenance properties with strong rental potential. Popular urban neighborhoods — close to the city center, public transit, and entertainment hubs — offer units with steady tenant interest and competitive prices. If you’re interested in exploring your options, you can search for new properties on Owncondo to identify investment opportunities in the city’s diverse condo landscape.

Considering Townhomes

Townhomes in Calgary attract buyers and renters who desire more space than a condo but prefer less upkeep than a single-family home. These properties often feature modern amenities, attached garages, and private yards. They are popular in family-friendly neighborhoods and areas with convenient access to schools and parks — traits that support a stable, long-term rental market.

Exploring Detached Houses

Detached houses, including duplexes and row houses, combine affordability and versatility. These properties can appeal to budget-conscious buyers, first-time investors, and downsizers who seek a balance of space, maintenance ease, and cost-effectiveness. Investors looking to diversify their portfolios may find attached homes appealing, as they often yield steady returns and have consistent tenant demand.

For more information on investing in Alberta’s broader real estate market, you can learn more here.

Real Estate Market Trends in Calgary

Compared to other major Canadian cities like Toronto and Vancouver, Calgary’s housing market offers more affordability. While prices have risen gradually, they are still more accessible, allowing investors to acquire properties with lower initial capital outlays. Rental yields have also remained healthy, supported by a relatively balanced supply-demand ratio. Vacancy rates, historically in the low single digits, reinforce stable rental income opportunities.

Recent data from CREB and Canada Mortgage and Housing Corporation (CMHC) suggest that the Calgary market has weathered external economic pressures better than expected. Projections indicate moderate price growth over the next few years, driven by consistent population increases, robust employment prospects, and an improving diversification of the local economy.

Consider watching this informative video for a visual overview and expert perspectives on Calgary’s market.

Neighborhoods Worth Investing In

- Beltline: Located just south of downtown, Beltline is known for its vibrant urban atmosphere, walkability, and proximity to amenities. Condominiums and rental apartments are in high demand, offering solid cash flow potential.

- Kensington: This trendy inner-city neighborhood boasts boutique shops, cafes, and excellent transit access. Property values here have appreciated steadily, appealing to investors who value long-term capital gains.

- Springbank Hill: Situated in Calgary’s southwest, Springbank Hill offers a suburban feel with upscale homes, green spaces, and reputable schools. Families looking for quality living environments drive consistent demand.

- Emerging Areas: Up-and-coming communities like Seton, Mahogany, and Livingston are experiencing rapid development, making them prime spots for forward-looking investors. These neighborhoods often offer pre-construction opportunities, which can translate into early equity gains.

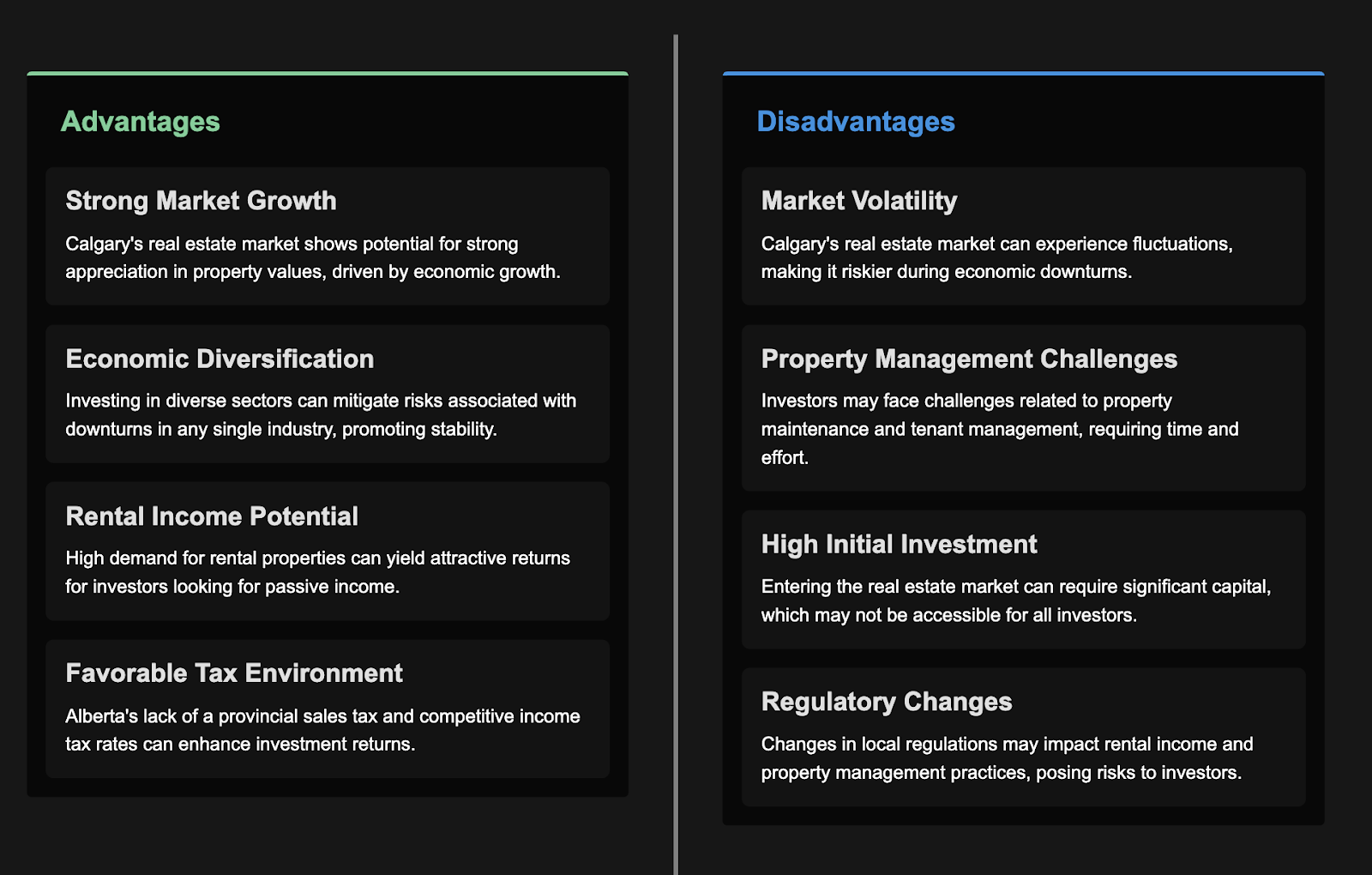

Pros and Cons of Investing in Calgary Real Estate

Benefits of Investing in Calgary Real Estate

- Affordability: Lower entry prices than Toronto or Vancouver enable investors to get more value.

- Market Stability: Calgary’s growing economy and population create sustained demand for housing, reducing the risk of prolonged market downturns.

- Strong Growth Potential: Ongoing diversification efforts bolster long-term prospects, ensuring that property values and rental rates keep pace with economic growth.

- Rental Appeal: The city’s thriving job market attracts a steady influx of tenants, making rental units consistently in demand, especially in central neighborhoods.

Challenges and Risks to Consider

While promising, Calgary’s real estate market does not come without its complexities. Investors should be mindful that shifts in the energy sector can still influence employment levels and consumer confidence, affecting housing demand and property values over time. Regulatory factors, such as property taxes and evolving landlord-tenant policies, require ongoing attention to ensure compliance and profitability. Additionally, the city’s real estate landscape may experience short-term market fluctuations, making a thoughtful, long-term strategy essential for those seeking stable returns.

Conclusion

Calgary’s real estate market is a compelling investment opportunity, thanks to a balanced blend of affordability, economic growth, and stable rental demand. While there are potential challenges — such as the city’s lingering ties to the energy sector — the broader outlook remains positive. Calgary offers strong capital appreciation and cash flow potential for investors willing to conduct due diligence, collaborate with local professionals, and maintain a long-term perspective. Ready to explore opportunities? Consider contacting a local real estate expert or browsing current listings to kickstart your Calgary investment journey.

FAQs

- Q: What is the average ROI for rental properties in Calgary?

- A: The average return on investment (ROI) varies by neighborhood and property type, but many investors report annual rental yields between 4% and 6%. Well-located properties can achieve even higher returns, especially over the long term.

- Q: Which neighborhoods in Calgary are best for first-time investors?

- A: Popular choices include Beltline, Kensington, and newly developed suburbs like Seton or Livingston. They offer a balance of affordability, strong rental demand, and potential for long-term appreciation.

- Q: How does Calgary’s real estate market compare to Toronto or Vancouver?

- A: Calgary’s market is generally more affordable and less volatile than Toronto and Vancouver’s. While appreciation rates may be more modest, the lower entry costs and stable rental demand make it an attractive option for investors looking for sustainable long-term growth.