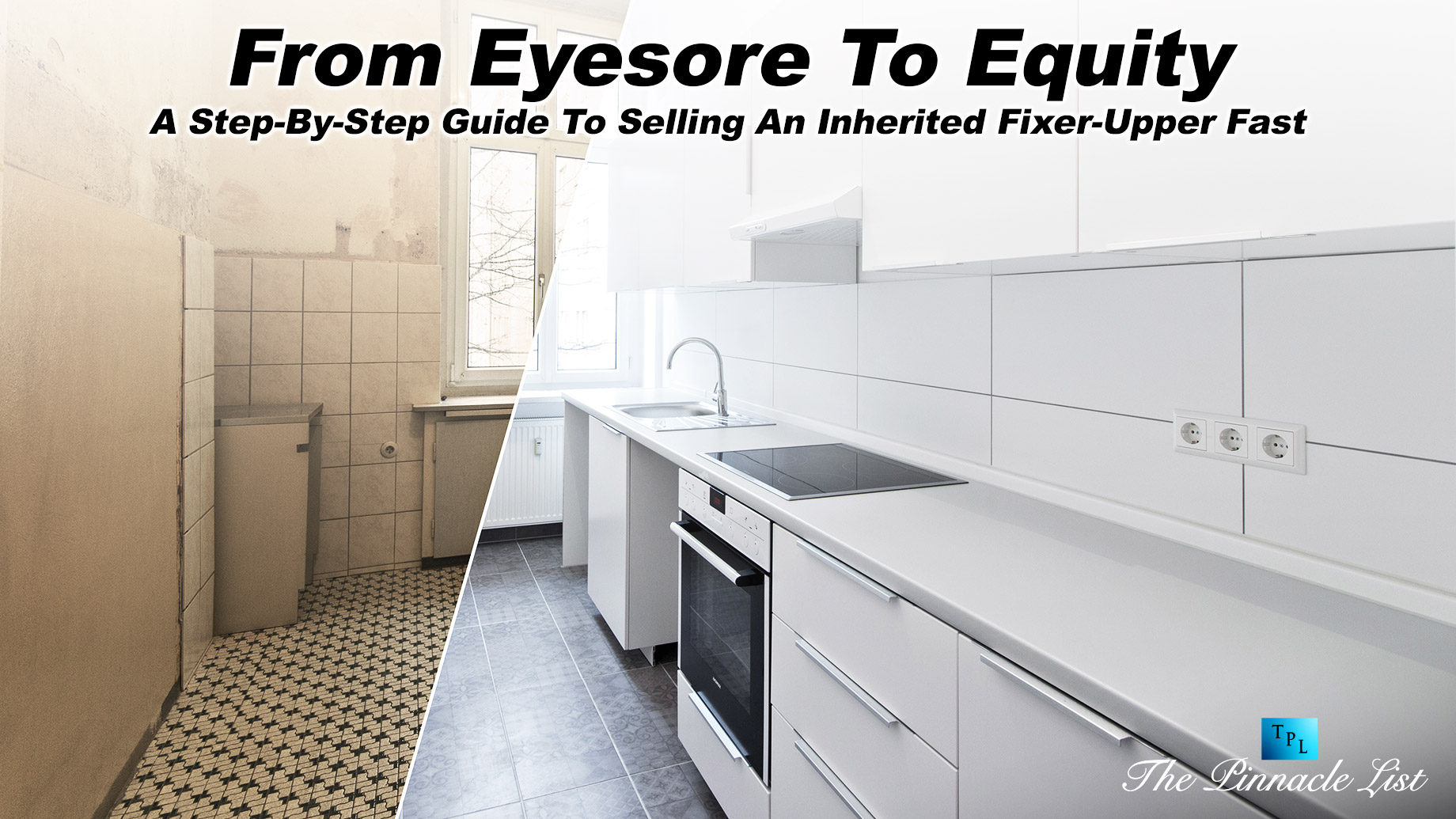

Inheriting a property from a loved one can be a bittersweet experience, especially when the property in question is a fixer-upper that’s been neglected for years. The emotional weight of dealing with a deceased family member’s belongings and the physical burden of renovating a dilapidated home can be overwhelming. But what if you could turn that eyesore into a valuable asset, generating a significant profit and helping you to heal and move forward in the process?

With the right strategies and a clear plan of action, it’s possible to transform an inherited fixer-upper into a lucrative sale, freeing you from the stress and uncertainty that often accompanies inherited property.

In this comprehensive guide, we’ll walk you through the step-by-step process of selling an inherited fixer-upper fast, from assessing the property’s condition to finding the right buyer, and provide you with the expert advice and practical tips you need to turn a potential liability into a valuable asset.

The Challenges Of Inheriting A Fixer-Upper

Inheriting a fixer-upper can be a double-edged sword. On one hand, you’ve received a potentially valuable asset without having to pay for it. On the other hand, you’re now saddled with a property that can be a money pit, a time-suck, and a source of endless stress. The emotional weight of dealing with a deceased loved one’s estate can be overwhelming, and the added burden of a run-down property can feel like the final straw.

The reality is that inherited fixer-uppers often come with a unique set of challenges. The property may have been neglected for years, with outdated systems, structural damage, and a plethora of needed repairs. The previous owner may have been a hoarder, leaving behind a treasure trove of clutter and junk. Or, the property may be stuck in a time warp, with retro decor and outdated appliances that are more eyesore than nostalgic charm.

Additionally, inherited fixer-uppers can be a logistical nightmare. You may be dealing with a property that’s located far from your current residence, making it difficult to manage and maintain. You may also be facing a tight deadline to settle the estate, which can add pressure to sell the property quickly.

And, to top it all off, you may be navigating the complex and often emotional process of dividing the estate with other family members or beneficiaries. It’s no wonder that selling an inherited fixer-upper can feel like a daunting task. But, with the right strategies and mindset, it’s possible to turn this eyesore into a valuable asset – and fast.

Assessing The Condition Of The Inherited Property

As you step into the inherited property, you may be hit with a mix of emotions – nostalgia, sadness, and perhaps a hint of overwhelm. The once-familiar home, now a testament to years of neglect, stares back at you with a long list of needed repairs and upgrades. But before you can start envisioning the transformed space, it’s essential to take a step back and assess the property’s condition with a critical and objective eye.

Walk through each room, taking note of the condition of the walls, floors, ceilings, and windows. Check for signs of water damage, structural issues, and termite infestations. Make a mental (or better, written) note of the functional aspects of the property, such as the plumbing, electrical, and HVAC systems. Are the appliances outdated or still in working order? Are there any signs of mold or asbestos?

Take photos and videos to document your findings, and consider hiring a professional home inspector to identify any potential issues that may not be immediately apparent. This thorough assessment will not only help you prioritize repairs but also provide a realistic understanding of the property’s value, allowing you to set a competitive selling price and attract potential buyers.

Determining Your Goals: Selling Fast Vs. Maximizing Profit

When it comes to selling an inherited fixer-upper, it’s essential to define your goals from the outset. Are you looking to sell the property quickly and move on from the emotional and financial burden, or are you willing to invest time and effort to maximize your profit? The answer to this question will significantly impact your approach to selling the property.

Selling fast often means sacrificing some of the profit margin, but it can also bring a sense of relief and closure. On the other hand, maximizing profit requires a more strategic and patient approach, which may involve investing in renovations, staging, and marketing. Consider your current financial situation, the condition of the property, and your personal preferences when deciding which path to take.

If you’re looking to sell quickly, you may need to be more flexible with your pricing and be prepared to negotiate with potential buyers. You may also need to consider selling the property as-is, which can attract cash buyers and investors who are looking for a fixer-upper project. On the other hand, if you’re willing to invest time and effort into maximizing your profit, you can focus on renovating the property to increase its appeal and value.

Ultimately, determining your goals will help you create a clear plan of action and ensure that you’re taking the right steps to achieve your objectives. By understanding your priorities, you can make informed decisions about pricing, marketing, and negotiations, and ultimately sell your inherited fixer-upper for the best possible outcome.

Gathering Essential Documents And Information

As you embark on the journey of selling your inherited fixer-upper, it’s essential to gather all the necessary documents and information to make the process as smooth and efficient as possible. Think of this step as laying the groundwork for a successful sale. You’ll want to dig up all the relevant paperwork, records, and details about the property to demonstrate its value to potential buyers.

Start by collecting documents such as the property deed, title report, and any outstanding mortgage or loan information. You’ll also want to gather records of any past renovations, repairs, or maintenance work done on the property, including receipts and invoices. Additionally, make sure you have a clear understanding of the property’s boundaries, zoning laws, and any potential environmental concerns.

It’s also crucial to have a comprehensive understanding of the property’s condition, including any needed repairs or updates. Consider hiring a professional inspector to identify potential issues and provide a detailed report. This will not only give you a better understanding of the property’s condition but also provide transparency to potential buyers.

By gathering all the necessary documents and information, you’ll be able to present your inherited fixer-upper in the best possible light, attract serious buyers, and ultimately sell the property quickly and for the best possible price.

Researching The Local Real Estate Market

When it comes to selling an inherited fixer-upper, understanding the local real estate market is crucial to determining the right price, attracting the right buyers, and ultimately, selling the property fast. It’s essential to dig deep and uncover the hidden gems that will give you a competitive edge in the market.

Start by analyzing the current market trends, including the average sale prices of similar properties in the area, the number of days they’ve been on the market, and the types of buyers who are actively looking. This will help you identify the sweet spot for your fixer-upper’s price and tailoring your marketing strategy to appeal to the right audience.

Delve into the local demographics, including the age, income, and lifestyle of potential buyers. Are they young professionals looking for a starter home, or families seeking a larger space? Are they drawn to the area’s schools, transportation, or amenities? Knowing your target audience inside and out will help you highlight the property’s best features and downplay its flaws.

Additionally, research the local economy and any upcoming developments or projects that may impact the property’s value. Are there any new businesses or infrastructure projects in the pipeline? Will they increase the property’s desirability or decrease its value? Having a finger on the pulse of the local market will enable you to make informed decisions and set a realistic asking price.

By doing your due diligence and gathering insights into the local real estate market, you’ll be well-equipped to position your inherited fixer-upper for a quick sale and maximize its potential.

Estimating Renovation Costs And Potential ROI

As you stand in the midst of the inherited fixer-upper, it’s easy to feel overwhelmed by the sheer amount of work that needs to be done. But before you can start imagining the potential of your new property, you need to get a handle on the costs involved in bringing it back to life. Estimating renovation costs is a crucial step in the selling process, as it will not only help you determine your budget but also give you a clear understanding of the potential return on investment (ROI) you can expect.

From replacing outdated plumbing and electrical systems to updating the kitchen and bathrooms, every renovation project comes with its own set of expenses. And while it’s impossible to predict every cost that will arise, a thorough assessment of the property’s condition can help you identify the most critical areas that need attention. By prioritizing the most essential repairs and upgrades, you can create a realistic budget that will help you stay on track and avoid costly surprises down the line.

But estimating renovation costs is only half the battle. You also need to consider the potential ROI of your investment. Will the renovations you make increase the property’s value enough to attract potential buyers and justify the cost? By researching the local market and understanding what buyers are looking for in a property, you can make informed decisions about which renovations will have the greatest impact on the sale price. With a clear understanding of both the costs and potential ROI, you’ll be well-equipped to make the most of your inherited fixer-upper and sell it quickly for a profit.

Deciding Whether To Renovate Or Sell As-Is

As you stand in the midst of your inherited fixer-upper, surrounded by peeling paint, creaky floors, and a general sense of disrepair, it’s natural to wonder: should I invest time and money into renovating this property, or is it better to sell it as-is? This is a crucial decision, one that can significantly impact the sale of your inherited property and the profit you ultimately walk away with.

Renovating can be a costly and time-consuming endeavor, but it can also increase the value of your property and attract more buyers. On the other hand, selling as-is can be a quicker and more straightforward process, but it may limit your buyer pool and result in a lower sale price. The key is to strike a balance between investing in the right renovations to boost value and avoiding costly over-improvements that won’t yield a significant return. By carefully considering your budget, the local market, and the property’s condition, you can make an informed decision that sets you up for success in the sale of your inherited fixer-upper.

Pricing The Property Competitively For A Quick Sale

When it comes to selling an inherited fixer-upper, pricing the property correctly is crucial to attracting potential buyers and securing a quick sale. You need to strike a delicate balance between maximizing your profit and being realistic about the property’s condition. If you price the property too high, you’ll deter potential buyers and leave the property languishing on the market for months. On the other hand, if you price it too low, you’ll sacrifice your hard-earned equity.

To determine the optimal price, research the local market to identify comparable properties that have recently sold. Take into account the property’s condition, size, location, and amenities, as well as any necessary repairs or renovations. Consider hiring a professional appraiser to provide an objective assessment of the property’s value.

It’s also essential to be prepared to negotiate and be flexible with your pricing. Be open to reasonable offers and counteroffers, and be willing to throw in some extras, such as including appliances or offering a home warranty, to sweeten the deal. By pricing the property competitively and being willing to negotiate, you’ll increase the chances of selling your inherited fixer-upper quickly and for a fair price.

Marketing Strategies To Attract Potential Buyers

When it comes to selling an inherited fixer-upper, traditional marketing methods may not be enough to attract potential buyers. You need to think outside the box and get creative to stand out in a crowded market. Here are some innovative marketing strategies to help you attract potential buyers and sell your property fast.

First, high-quality visuals are a must. Invest in professional photography and videography to showcase the property’s best features. Virtual tours and 3D walkthroughs can also give buyers a more immersive experience, helping them envision the property’s potential.

Next, leverage social media platforms to reach a wider audience. Share before-and-after photos, videos, and testimonials to build excitement and generate interest. You can also utilize online real estate platforms, such as Zillow or Redfin, to reach a larger pool of potential buyers.

Another effective strategy is to host an open house or private viewing event. This allows buyers to see the property in person and get a sense of the neighborhood. Offer incentives, such as a “fixer-upper” discount or a credit towards renovations, to sweeten the deal. Finally, consider partnering with a local real estate agent or investor who specializes in fixer-uppers. They often have a network of potential buyers and can help you negotiate the best possible price.

By implementing these marketing strategies, you can attract more potential buyers and increase your chances of selling your inherited fixer-upper quickly and for a good price.

Negotiating Offers And Closing The Deal

The moment of truth has finally arrived! After weeks or even months of hard work, your inherited fixer-upper is now a stunning gem that’s attracting serious buyers. You’ve received multiple offers, and it’s time to navigate the complex process of negotiating and closing the deal. This is where your patience, persistence, and negotiation skills will be put to the test.

As you sift through the offers, remember to stay calm and objective. Don’t let emotions cloud your judgment, and carefully consider each proposal’s pros and cons. Be prepared to counteroffer, and don’t be afraid to walk away if the terms aren’t right. Your goal is to secure a fair price that reflects the true value of your renovated property.

Once you’ve accepted an offer, the real work begins. You’ll need to work with the buyer to finalize the sale, which involves a flurry of paperwork, inspections, and appraisals. Stay organized, and keep the lines of communication open with the buyer, their agent, and your own team.

You may also be facing a tight deadline to settle the estate, which can add pressure to sell my house fast Connecticut. With careful planning and attention to detail, you’ll be able to close the deal quickly and efficiently, putting the inherited fixer-upper saga behind you and pocketing a handsome profit.

Inheritance Taxes And Inheritance Laws

The complexities of inheritance taxes and laws can be a daunting hurdle to overcome when dealing with a fixer-upper inherited from a loved one. It’s essential to understand the intricacies of inheritance laws in your state or country to avoid costly mistakes and potential legal battles. Inheritance taxes, in particular, can be a significant burden, eating into the equity of the property and reducing the amount you can pocket from the sale.

For instance, if you inherit a property with a significant amount of outstanding debt, you may be responsible for paying off those debts before you can sell the property. Additionally, if the property is held in a trust or has multiple beneficiaries, the process of selling the property can become even more complicated. Failure to navigate these complexities correctly can lead to disputes among beneficiaries, delayed sales, and even legal action.

To avoid these pitfalls, it’s crucial to consult with a qualified attorney or tax professional who is well-versed in inheritance laws and taxes in your area. They can help you understand your obligations, guide you through the process of resolving any outstanding debts or disputes, and ensure that you’re taking advantage of all available tax deductions and exemptions. By doing so, you can minimize the financial burden of inheritance taxes and laws, and maximize the equity you can gain from the sale of the inherited fixer-upper.

Conclusion

As you stand in front of the inherited fixer-upper, once a burden and now a potential goldmine, you can’t help but feel a sense of pride and accomplishment. The journey from eyesore to equity wasn’t an easy one, but with the right mindset, strategies, and expertise, you’ve managed to transform a dilapidated property into a valuable asset. The peeling paint, creaky floors, and outdated fixtures are now a distant memory, replaced by a modern, beautifully restored home that’s ready to attract potential buyers.

By following the step-by-step guide outlined in this article, you’ve successfully navigated the complex process of selling an inherited fixer-upper, from assessing the property’s condition to staging it for maximum appeal. You’ve overcome the emotional hurdles, tackled the renovations, and positioned the property to attract top-dollar offers. As you prepare to hand over the keys to the new owners, you can’t help but feel a sense of relief, knowing that you’ve not only honored the memory of your loved one but also secured a profitable return on your investment. Congratulations, you’ve turned an inherited eyesore into a valuable asset, and it’s time to reap the rewards.