As far as California is concerned, where housing prices are amongst the highest in the United States, FHA loans in California have become an essential tool to make homeownership achievable for many aspiring buyers.

Flexible eligibility requirements, low down payments, and other assistance programs make FHA loans transform the accessibility landscape of California’s challenging real estate market.

Read on further to understand how FHA loans work and why they make a big difference in California for affordable homeownership.

What are FHA Loans?

FHA loans are federally insured mortgages from the Federal Housing Administration that aid in home purchases by low and moderate-income individuals. Established in 1934, FHA’s primary objective is to foster home ownership. It aims to alleviate stringent mortgage qualifications such as high credit scores and down payments. This endeavor is most important in California because the high cost of living may make other loan types inaccessible to many potential buyers.

It is also flexible to refinance FHA loans to enable California homeowners to acquire better terms or lower their monthly payments. The feature of the FHA refinance allows Californians flexibility and relief in their finances, especially when the housing prices fluctuate. The Californians will be able to continue enjoying good terms by having to refinance FHA loans to ensure long-term stability in homeownership.

Key Ways FHA Loans Make Homeownership Accessible

1. Low Down Payment Requirements

Lower Barriers to Homeownership California FHA mortgages reduce one of the significant barriers to buying and keeping a home the deposit for a mortgage. According to FHA, you need as little as 3.5% for purchases with scores above 580 and can invest 10% on acquisitions with a score between 500 and 579.

That can all be very beneficial with this type of FHA construction loan, and for consumers not very well equipped financially or perhaps with some kind of economic crisis. It helps them enter the housing market with a reduced burden and even a lower entry cost.

2. Lenient Credit Score Standards

FHA loans also offer flexibility to borrowers with less than stellar credit. Most conventional loans look for a high credit score, but FHA loans work with scores as low as 500, though they demand a higher down payment at this level.

This opens the door for new buyers or those with just a short credit history as they can have a shot at homeownership. It gives a level of financial inclusion that is sorely needed in a hot market like California’s.

3. Adjustable Loan Limits for High-Cost Regions

The housing market depends on the region, and it is precisely for such differing local demands that FHA offers loans with different localized limits. For the state of California, FHA has set the loan limit around the standard area at $498,257.

The figure goes as high as $1,149,825 in the more demanding regions such as Los Angeles or San Francisco. They have adaptable loan limits to help these various borrowers find the kind of financing that suits their affordability concerning housing purchases in competitive regions.

4. Availability of Down Payment Assistance Programs

CalHFA assists with down payment and closing costs under the California Housing Finance Agency. These programs make the home even more affordable because they cover a portion of the upfront costs, thus making FHA loans more accessible to low- and moderate-income buyers.

FHA Loan Qualification Requirements for Homeownership in California

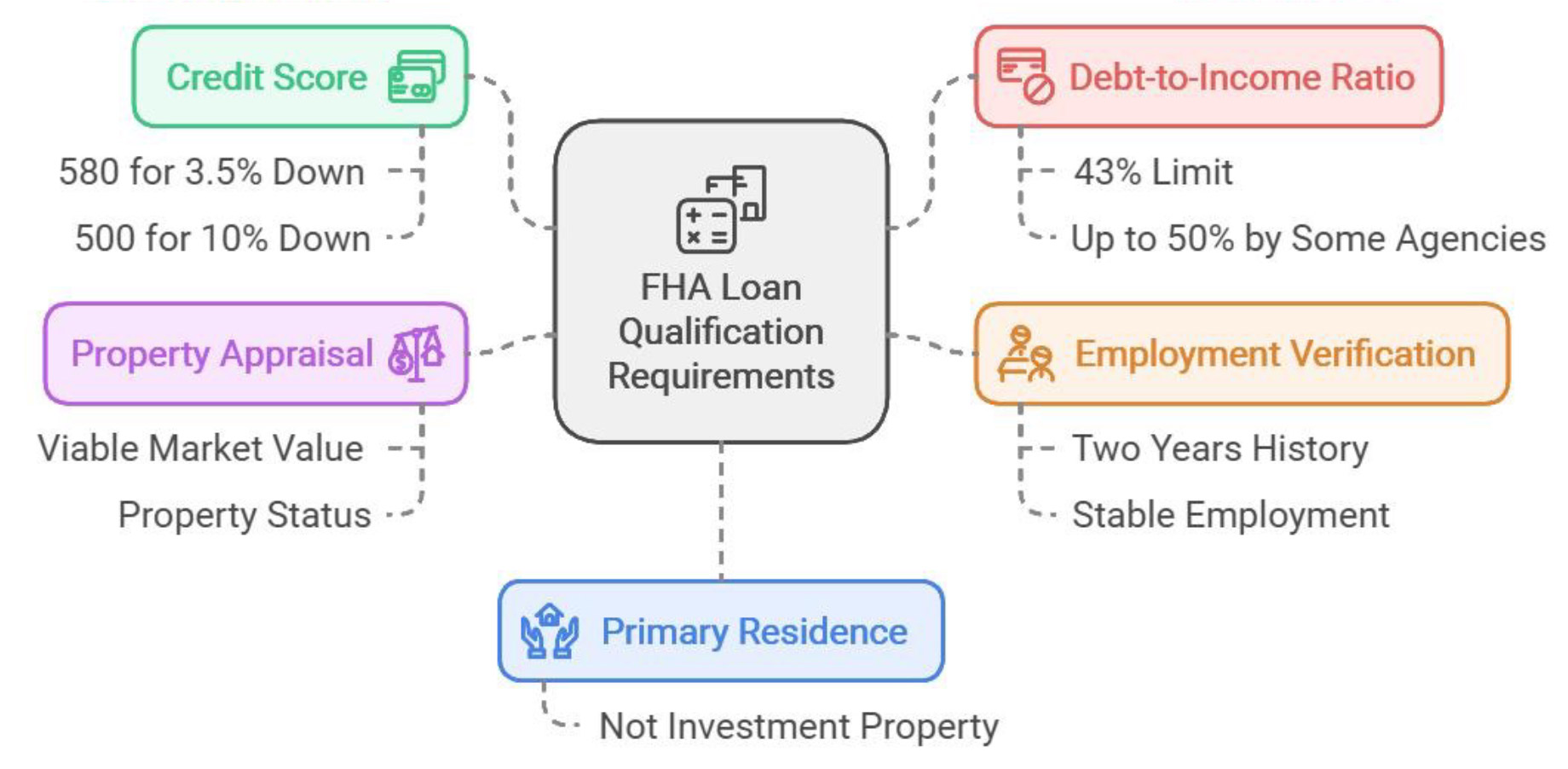

An applicant must meet simple conditions to qualify for the FHA loan:

- Primary Residence: It needs to be used as a primary residence for the buyer. It cannot be an investment property.

- Credit Score: The lowest required credit score is 580 for 3.5% down, and they will accept 500 using a 10% down payment.

- Debt-to-Income Ratio (DTI): The DTI should not exceed 43 percent, but some agencies can accommodate up to 50 percent.

- Employment Verification: There is typically a history of two years of employment based on stable employment.

- Property Appraisal: FHA requires an appraisal to determine whether the property has a viable market value and its status.

These requirements are aptly tailored to be available to many potential buyers, thus dispelling many obstacles to buying a home in expensive markets.

The Effects of FHA Loans on Homeownership in California

FHA loans immensely affected California’s housing sector by expanding the pool of available homebuyers to include first-timers and those with various financial backgrounds. This facilitated access led to higher homeownership rates, more robust economic stability, and increased community wealth.

Essential Statistics of FHA Loans in California

- First-Time Buyers: Approximately 30% of the FHA loans are given to first-time buyers, proving that it is essential in enabling new homeowners.

- Regional Loan Limits: In standard areas, it ranges from $498,257 to $1,149,825 in the high-cost area. And this is very much possible throughout the state.

- Average Homeowners Insurance: The average California homeowner will pay around $1,200 per year in homeowners insurance costs, which a home buyer can control by using FHA loans, low down payments, and help opportunities.

Conclusion: FHA Loans: The Ticket to Homeownership

It makes more Californians reach home ownership using the FHA loans because it takes low down payment and has friendly credit scores and other county-based limits. Due to its flexible credits, which allow one to obtain a lower down payment than what a person might borrow, the FHA loan in California has a significant impact. It helps ensure the attainment of California residents’ dreams of becoming homeowners at some time. With providers like Munshi.Biz, FHA loans continue to be an accessible pathway to homeownership for many in California.