When most people around the world search for real estate investment opportunities in Canada, they usually instantly think about buying an existing home or a condo. But Canadian real estate options don’t just cover homes, condos and lots, you should also take a look at rural land purchase and country acreage ownership as an option. There are many reasons why people purchase rural land, some want to buy and hold it as a long-term investment, some want a second home for their family, while others are simply looking for a vacation property that is a great location for a cabin.

Ontario is the most popular province

Over 14 million people live in Ontario, making it the most populous region in Canada. The southern portion of the province is very densely populated with many interconnected cities. For short term investors, the safest option is to choose a land purchase in the south, since you will be able to find a property closer to major road routes, water supplies and electricity. However, land prices in developed areas can be prohibitively expensive.

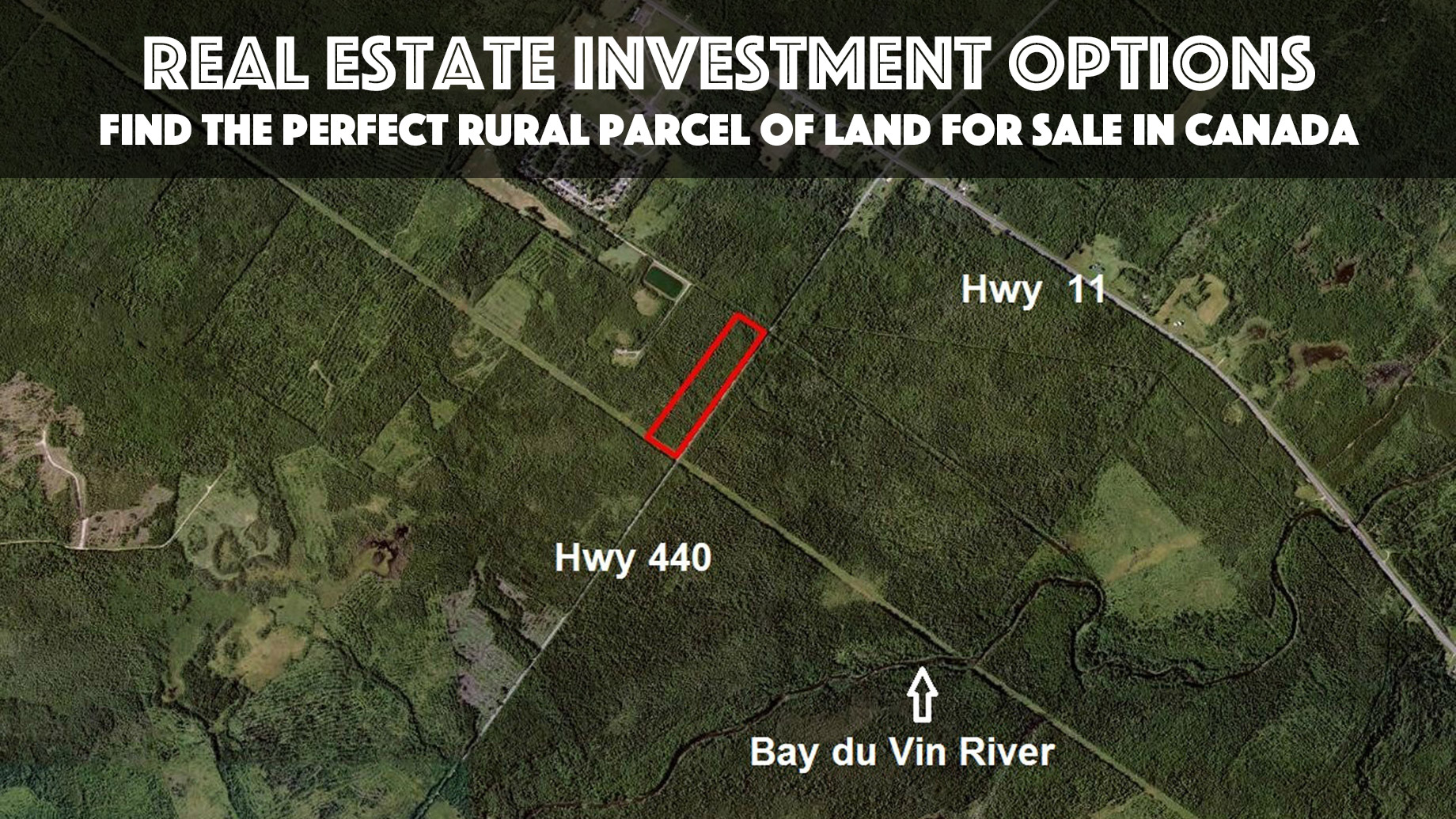

Northern Ontario is sparsely populated, with smaller villages and towns set far apart in most cases. Access to utilities and infrastructure is limited, bringing a risk factor to any investment. On the flip side, the cost of land is very low, meaning that you can easily find a large piece of land to purchase from as little as $10,000 – $20,000 CAD. The land is usually available in large parcels, which makes it perfect for hunting, summer vacation spots, wilderness hideouts or even for building your own family cabin to live in.

Making money from the land

There are those who would like to invest in land as a simple buy & hold investment strategy. While more creative investors might be looking to create a business opportunity that generates positive cash-flow.

Plenty of people invest in land and turn it into a profitable business.

Here are a few examples:

- Holding the land for future sale is a good return on investment (ROI). The return can be very high, you would need to understand how land in the area appreciates. With properties closer to a population centre, you can also clear the land to get it ready for development, this increases the ROI drastically.

- Boat storage facilities can generate monthly revenue from storage fees which can result in some great earnings depending on the property location. People will store their boats all winter long, bringing great ROI. Come summertime, people will take their boats to water.

- Depending on the size and timber on the land, foresting wood can be very lucrative. You can use the wood for your own firewood sales business, since a lot of people in rural areas use wood burning stoves for heating homes during the cold season.

- A lot of city slickers don’t have the space to keep their large RV’s on their own property which can make for a very lucrative opportunity for your vacant land. You would need to allow access to land, so security is key in that business. Depending on RV size and the property location, storage costs can be anywhere from $50 per month up to $400 per month. Indoor, dry storage RV storage is the most expensive and desirable for owners so building storage sheds might also be an option.

- Camping outdoors is what a lot of Canadians do best! Using your land for hard surface RV space could bring great income potential. The most revenue would come from those who enjoy tenting and day camping which would bring more income.

Can non-residents buy Canadian land?

There are very few foreign ownership purchase restrictions on private (non-crown) rural land in Canada except for certain controls of large plot purchases, commercial ventures and agricultural land in some provinces. Being a non-resident has nothing to do with citizenship. Canadian lenders generally define a non-resident as those who do not earn an income within or file taxes in Canada. This does not mean you cannot borrow off a lender in Canada, it just means there are a set of different rules that apply to those who need to borrow to buy real estate. One of the main thing’s lenders do require is a larger down-payment than they would from a resident of Canada.