When it comes to understanding financial statements, you should first look for an example of financial statement templates online, as that can help alleviate the nerve-wracking experience of getting started. For one, you have to understand the basic concepts of accounting to make heads or tails of the statement. In addition, you need to be able to read and comprehend the language of finance. It can be difficult to know where to start and what’s important. However, with a little bit of effort, you can gain a basic understanding of financial statements and their importance.

Necessary Contents Of A Good Example Of A Financial Statement

One of the most important accounting documents that your business will need is financial statements. It’s set out in a conventional format, with the income statement first and then a balance sheet at the end to show what your business is worth.

So, if you want to know how to write your financial statements, each section is described below, together with some examples. Any jargon will also be explained, so it doesn’t seem too alien or complicated!

Part 1: Income Statement (Profit & Loss)

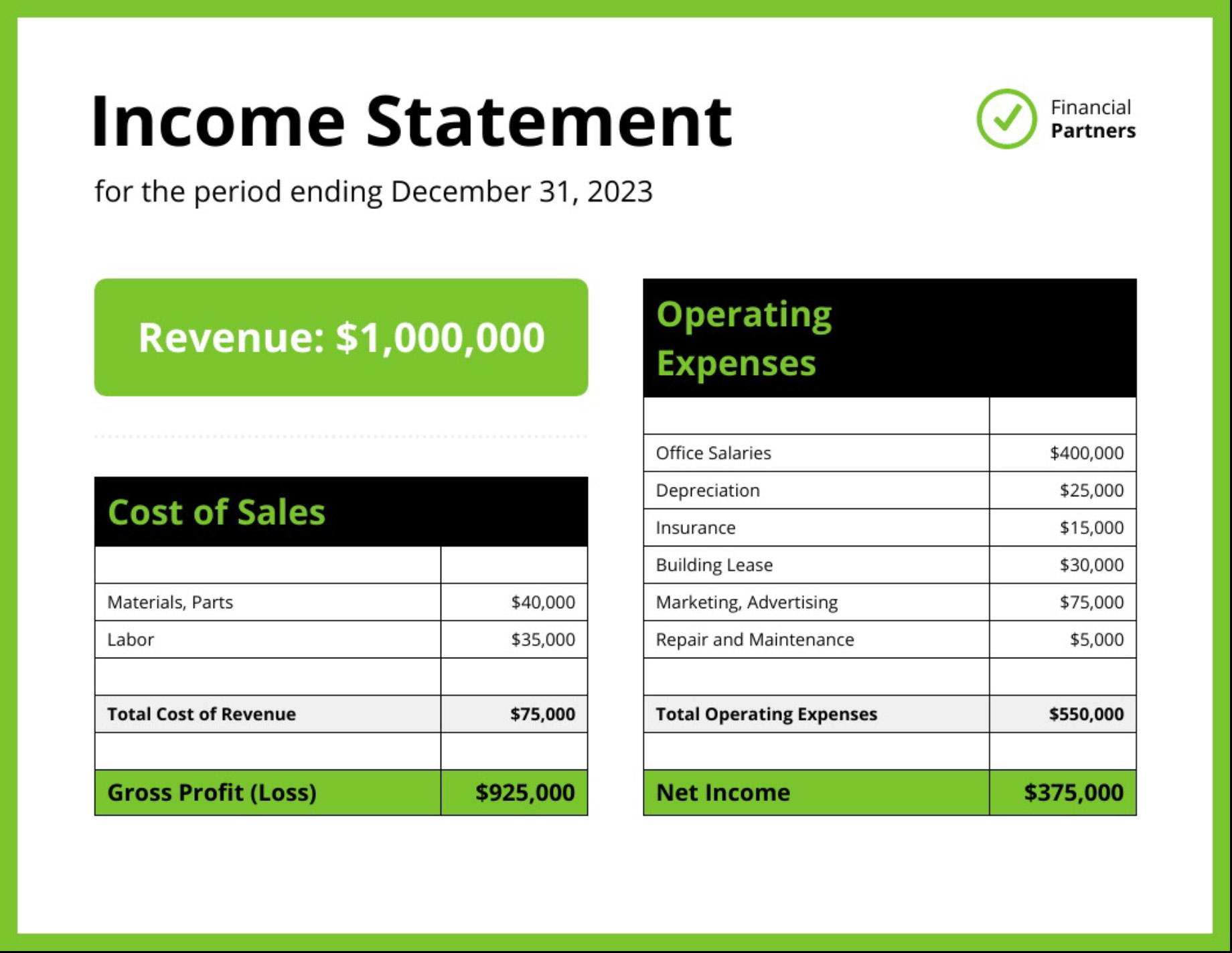

The purpose of this part of your financials is to tell investors or lenders about the money that comes into and goes out of your business over a set period – usually one year. This part starts with how much your business earned (revenue) and then subtracts costs/expenses to show you how much money the business made or lost.

So if you were to write a simple example of an income statement, it might look like this:

- Revenue: $15,000

- Expenses: $4,500

- Profit: $10,500

What does ‘Profit/Loss’ mean? It’s difficult to refer to something as ‘profit’ because the word is different depending on whether you’re talking about a small personal company (which is taxed in a different way to large corporate companies), and also between countries. So when people do their financial statements, they tend to use the term ‘Profit / Loss,’ which means ‘the money the business earned or lost.’

Part 2: Balance Sheet

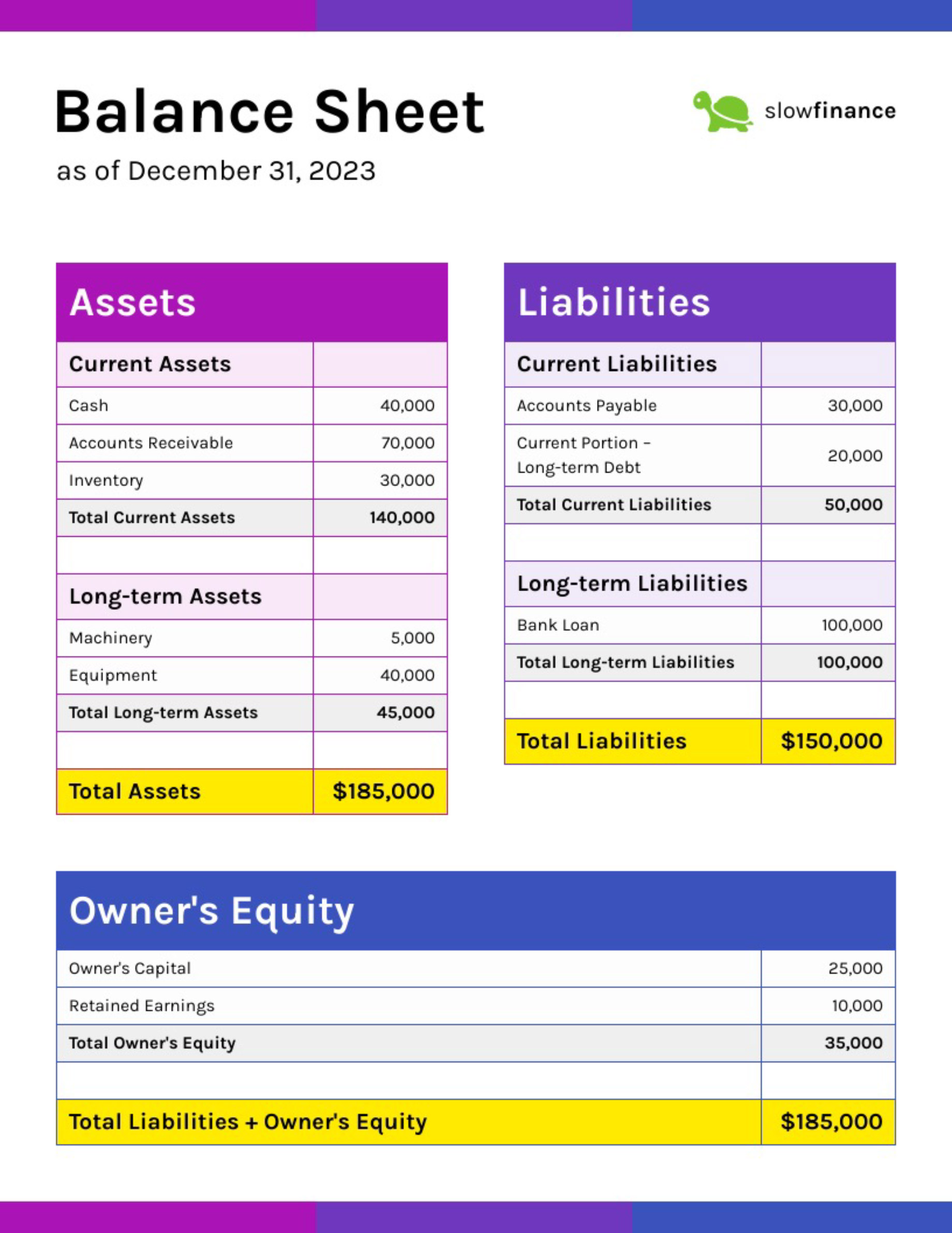

The balance sheet shows shareholders (or lenders) what your company is worth. It’s one of the most important parts of your financial statements, and it usually comes at the end after the income statement/profit and loss. A balance sheet has three segments: Assets, Liabilities, and Shareholders’ Equity. The balance sheet also holds useful information regarding the company in terms of leases. It’s important that if you’re doing your own accounting, you transfer or copy operating leases onto the balance sheet so that it’s accurately reflected.

Assets

What do you think would be included under assets? If someone asked you to write out a list of everything that belongs to your business, you might include things like cash in the bank, equipment, furniture, and computers. These are all classified as ‘assets.’ Anything that physically belongs to your company is included here.

Liabilities

The next section of your balance sheet is liabilities, which would include any loans that the business owes (e.g., money borrowed from the bank) and also unpaid bills/supplier credit. The liability section shows how much it costs to borrow money for you to run your business. Any debts are listed under liabilities because they must repay these amounts in the future.

Shareholders’ Equity

What about equity? This means how much shareholders are due after all assets have been used to pay off liabilities. And when this figure is positive, investors will know that their investment has increased in value over time because the revenue earned by the company was more than what was spent.

Part 3: Explanatory Notes (AKA Notes To The Accounts)

When you look at any financial statement for a company, you’ll usually see some information repeated again and again. And this is done in notes to the accounts because investors must read these sections before they invest their money. If you need help with your business plan, check out our article on how to write a business plan here. But briefly, there are three main parts of explanatory notes, which are listed below:

Who Is This Financial Statement For?

Before someone invests their money into any type of business, they want to know who owns or runs the business. So under the ‘Who’ section of your financial statements, you’ll need to put the names of anybody with significant control, which is defined as owners with more than 25% of the business. But if you’re a sole trader or partnership, this section doesn’t apply.

What Information Is Provided?

Investors must know exactly what type of information they are getting when they read your financial statements, hence why it needs to be listed under ‘What.’ If someone were looking at your statement for investment purposes, they’d expect to see different information compared to an accountant who’s just doing an audit check on your company. So make sure you list what kind of notes go with each explanation.

How Do These Figures Relate To Previous Periods (AKA Comparative Information)?

It’s good practice to list previous periods of your company if something has changed compared to the same period the year before. Even if things are the same, it’s still useful to show investors how well your business is doing by providing extra information on comparative figures.

Part 4: What’s Coming Up Next Year?

What good is a financial statement if it only shows results from the past year? Investors want to know what your business is going to be doing in the following year, so you need to provide information on what’s coming up for your company. Remember that things can change very quickly, and so it’s important to keep this part of your financial statement updated regularly. Some sections which come under ‘What Is Coming Up’ are:

- Capital Expenditure: This will show how much money you’re planning to spend on buying new equipment or renovating old equipment. If you’re making a loss, investors might think that it’s time for the company to invest in new resources.

- Income Statement Forecasts: When a company is going through a tough time, it can be difficult to estimate how much an income statement will look like in the future. So sharing forecasts with investors can make them feel more at ease about what you’ll be doing for next year’s earnings.

- Financial Risk Indicators: Obviously, there’s always some level of risk when you’re investing money into a business, as they could end up making a loss instead of profits. But financial risk indicators highlight things such as overreliance on one customer who isn’t doing so well financially or if something happens where your cost of sales suddenly increases significantly compared to last year.

If you’re considering a merger or acquisition, having the support of experienced merger and acquisition support specialists can help you navigate the complexities of financial statements and ensure that you have a comprehensive understanding of the financial health of the businesses involved.

Part 5: Financial Highlights

It’s not very helpful just to give all of the figures that are hard to interpret. But the ‘Financial Highlights’ section of a financial statement is designed to give some kind of overview of the information that has been given before. So this is where you’ll put things such as how long the company has been operating for and what its turnover was for that period.

Part 6: Other Information

And finally, your financial statements need to have an appendix section at the end, which will include all the legal jargon accompanied by information from other sources such as management letters or press releases. It’s important to make sure these references are listed somewhere because otherwise, they won’t be considered part of your financial statement itself.

So there you have it! Now you’ve seen what the necessary contents of a good example of a financial statement are; it’s time to get your hands wet. For an easy-to-understand example of financial statement templates, visit Venngage today so you can start with yours!