Property investment has always been considered as one of the best options to put your hard-earned money to work, as historically, real estate has been one of the best performing and appreciating asset classes. Today’s investment trends have also seen more and more property investors choosing to expand their options into overseas markets such as the United Kingdom. Consistently ranked as one of the best places in the world for anyone to purchase real property assets, there has been rising interest from global investors with the recent downward trend in UK property prices due to the ongoing uncertainty with the Brexit situation.

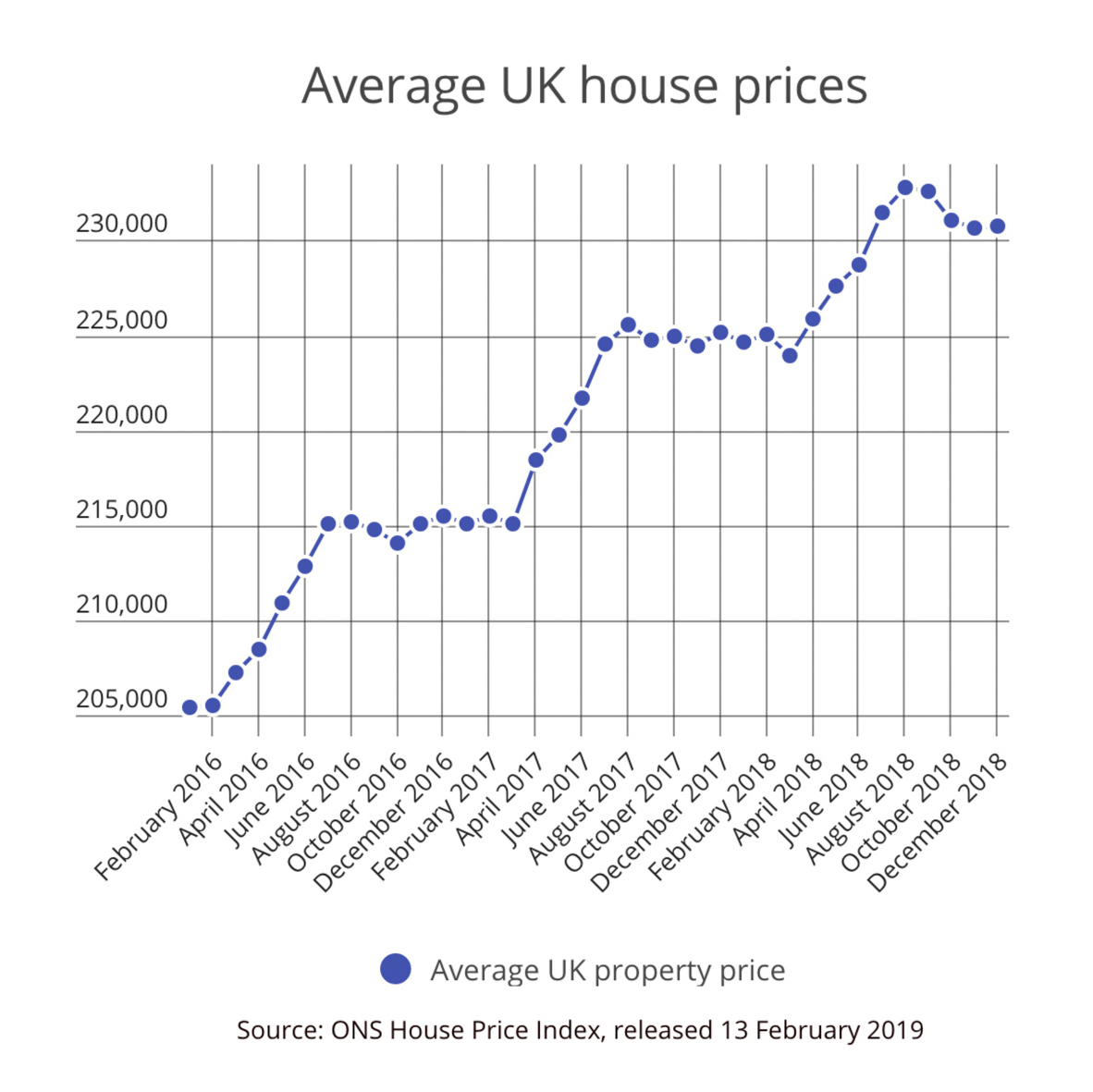

Following the Brexit referendum in June 2016, UK house prices did stagnate and plateau for a while, but then continued to rise after the initial shock was absorbed by the real estate market. As you can see from the chart below, another plateau started around August 2017 with more uncertainty hitting the news cycle.

While the outcome of Brexit is still uncertain, property prices are expected to react negatively if the UK leaves the EU without a Brexit deal in place. In September 2018 Mark Carney, the Bank of England governor warned that leaving the EU without a Brexit deal could send UK house prices tumbling by a third. Such a situation could provide the perfect buying opportunity for those looking to purchase their first overseas investment property.

Here are some of the pros and cons of investing in property in the United Kingdom:

The Pros

1. You could earn rental income while owning an excellent vacation home

More often than not, if you are looking at investing in an overseas residential vacation property you have the option of renting it out as a vacation home. An advantage that you can get from doing so is that on days when no one is renting out your property, you and your family can enjoy a great holiday in the UK in your own home! Property purchased in prime UK real estate markets is an excellent choice of earning a passive income from your investment.

2. Property investment is a stable long-term investment option

Choosing to invest in real estate has been seen as a more stable long term investment option in comparison with shares, stocks and other assets that tend to easily fluctuate in value. Even with the rise and fall of the economy, property investment in the UK has been attractive because global demand has seen a constant increasing trend over the long term.

3. The property investment market is lucrative and in demand

Albeit expensive, the real estate market in the UK has been quite good and stable. You should always be wary about investing your money in a country with problematic economic conditions. The financial status of the whole of the UK has been extremely resilient which makes it an excellent choice for foreign investment.

The Cons

1. It will be costly

There is no denying it: if you are looking to invest in property in the United Kingdom, you will need a lot of money! The UK, particularly London, is a very, very, expensive city, with property prices that are always on the rise. Currently, the demand for good investment homes is greater than the supply, which drives the price of houses for sale even higher. Hence, you will have to have a lot of cash on hand to purchase a property to if you need to create a positive cash-flow with your investment.

2. The taxes are quite high

With the current economic situation in the UK, it is a fact that the price of taxes is quite hefty, especially so for property investment. For example, if you are not from the UK and you already have property in the rest of the world or your own home country, you are charged an additional 3% stamp duty surcharge on your property. This amount is on top of all the other universal tax charges for purchasing property, such as capital gains and real estate tax.

3. Difficulty borrowing money for your mortgage

The Bank of England still sits at a borrowing rate of 0.5% interest, which is still relatively low, however, as a foreigner you may have problems borrowing money to cover the cost of the property that you seek to purchase because banks and other lenders are now becoming quite stringent on the application process. For example, even for UK residents, if they check your portfolio and can see that you may still have an ongoing mortgage, or that your other rental properties and businesses are not earning as much, your application for a property investment loan can be turned down. Cash inflow is always one of the top and heaviest weights of considerations that banks place on borrowers.

The uncertainty of Brexit has created the possibility of realizing a huge windfall for foreigners looking to make an overseas property investment. However the risk for those not following current UK property market trends can also result in missed opportunities, so seeking the advice of a property investment consultancy service is highly recommended before making any purchase decisions.